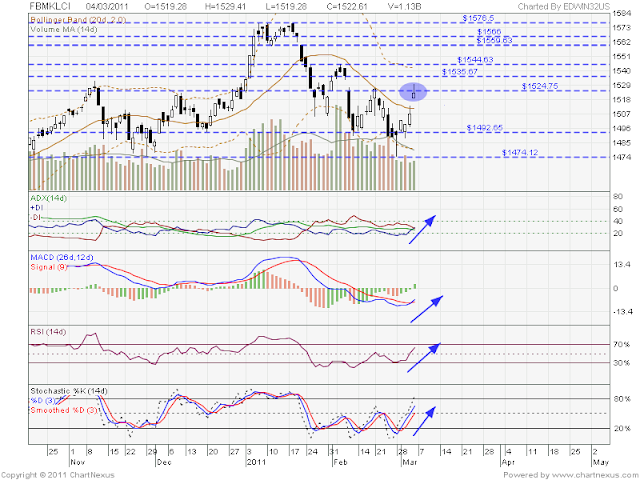

This could be a good time to take some profit

Observation

1) Trendline - Uptrend Bullish

2) Formed higher high - Bullish

3) MACD - Formed 4G1R ( Bearish Reversal)

4) RSI - Falling from 70% ( Bearish)

5) Sto - Bearish crossover ( Bearish)

6) ADX - Good momentum and bullish

7) Candle Stick - 2 black candle stick ( Bearish)

Conclusion

Be on lookout for this counter.

Resistance at 7.30

Support at 6.7

Observation

1) Trendline - Uptrend Bullish

2) Formed higher high - Bullish

3) MACD - Formed 4G1R ( Bearish Reversal)

4) RSI - Falling from 70% ( Bearish)

5) Sto - Bearish crossover ( Bearish)

6) ADX - Good momentum and bullish

7) Candle Stick - 2 black candle stick ( Bearish)

Conclusion

Be on lookout for this counter.

Resistance at 7.30

Support at 6.7