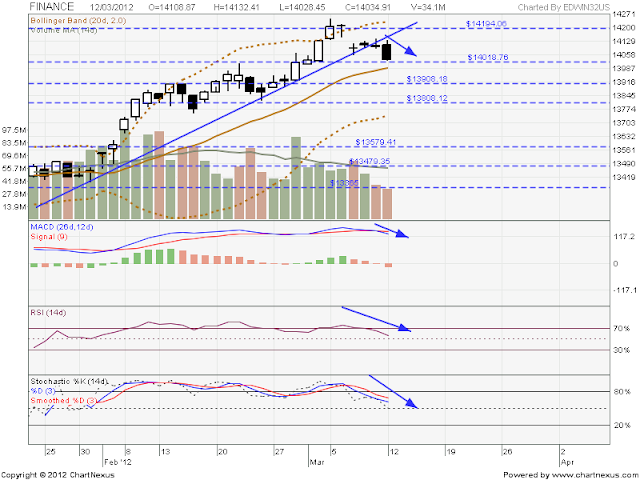

Construction sector was in downtrend mode following below the downtrend line and now testing the support ..

1) Downtrend line

2) Lower low and lower high ( Bearish)

3) MACD - FOrmed 4R1G ( Bullish - could be an early sign to rebound to break above the downtrend line)

4) RSI - Below 30% ( Bearish)

5) STO - Bull and Bear are clashing and need to wait for another few days to confirm

Entry Price - Break above 260

Support at 253,248 and 240

Resistance at 263 and 268

GAMUDA, MRCB and MUHIBAH are starting to peak up.. Could this be related with the GE?

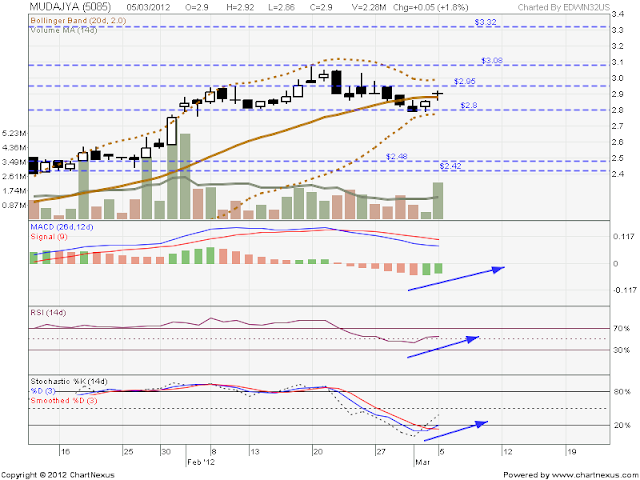

1) Downtrend line

2) Lower low and lower high ( Bearish)

3) MACD - FOrmed 4R1G ( Bullish - could be an early sign to rebound to break above the downtrend line)

4) RSI - Below 30% ( Bearish)

5) STO - Bull and Bear are clashing and need to wait for another few days to confirm

Entry Price - Break above 260

Support at 253,248 and 240

Resistance at 263 and 268

GAMUDA, MRCB and MUHIBAH are starting to peak up.. Could this be related with the GE?